Top 7 Automation Tools for Funded Traders

In today’s fast-paced prop trading world, automation tools are not just a luxury—they are a necessity. Funded traders rely on precision, speed, and data-driven decision-making to outperform the markets. In this comprehensive guide, we explore the top 7 automation tools, including Signal Stack and various AI trading tools, to help you harness state-of-the-art technology that transforms strategy development, backtesting, and risk management.

Why Automated Trading Tools Matter for Funded Traders

Successful prop trading relies on advanced technology integration. These platforms automate the backtesting process, facilitate data-driven decisions, and manage risk by continuously monitoring market conditions. Whether you are a junior trader or a seasoned quant, the right tools can optimize execution, improve efficiency, and reduce human errors. In this post, we focus on how to leverage these tools to enhance trading performance and compliance within dynamic regulatory environments such as MiFID II and ESMA regulations.

Key Features of Leading Prop Trading Automation Tools

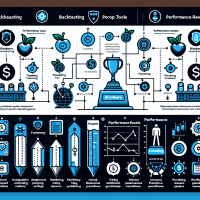

Automated trading platforms come with a host of features designed to address various aspects of prop trading. Some core functionalities include:

- Backtesting and Optimization: Tools such as TradingView and MetaTrader 5 offer both event-driven and vectorized backtesting, with automated parameter optimization and scenario analysis.

- Real-Time Data and High-Quality Historical Data: Platforms like NinjaTrader and QuantConnect provide deep historical data across multiple asset classes, along with real-time data integrations.

- Integration and API Access: Many tools support API connections with brokers and third-party analytics platforms, ensuring streamlined workflow (e.g., Interactive Brokers, Trade Ideas).

- Risk Management and Compliance: Advanced tools include features for stress testing, automated risk calculations (Sharpe ratios, drawdowns), and compliance tracking to meet regulatory guidelines.

In-Depth Comparison of Top Automation Tools

Below is a detailed side-by-side comparison of a few standout platforms:

| Tool | Backtesting Features | Data & Integration | Pricing & Use Cases |

|---|---|---|---|

| TradingView | Event-driven, detailed chart-based analysis; supports technical indicators and custom scripts. | High-quality historical data; broad asset class coverage; seamless broker integration. | Free and premium tiers; ideal for individual traders with community support features. |

| MetaTrader 5 | Supports both tick and bar data backtesting; automated optimization and stress testing. | Extensive market data; direct broker links; robust API support. | Free demo; competitive pricing for live accounts; suitable for both retail and prop trading firms. |

| NinjaTrader | Advanced backtesting with walk-forward analysis; supports automated parameter optimization. | Access to deep historical data and real-time feeds; excellent integration options. | Subscription-based model; scalable for team collaboration in prop firms. |

| QuantConnect | Cloud-based, supports algorithmic backtesting on multiple asset classes; high compute power for optimization. | Robust API access; integrated with major data vendors; supports both equities and futures data. | Freemium model; attractive for institutional and retail traders alike. |

Integrating Automated Tools into Your Prop Trading Workflow

Implementing these tools within your prop trading firm requires a methodical approach. Here are some step-by-step strategies:

1. Platform Integration and Data Management

Before deploying any algorithm, ensure you have reliable sources for historical tick and bar data. This is critical when configuring backtesting parameters. Tools like MetaTrader 5 and NinjaTrader support automated data cleansing and adjustments for corporate actions. Additionally, consider using a data management system to overlay complementary data sources, ensuring accuracy and eliminating look-ahead bias.

2. Advanced Backtesting Techniques

Avoid common pitfalls such as overfitting and survivorship bias by incorporating walk-forward optimization and out-of-sample testing. For instance, using a Python Backtrader snippet:

import backtrader as bt

class TestStrategy(bt.Strategy):

def next(self):

if not self.position:

if self.data.close[0] > self.data.close[-1]:

self.buy()

else:

if len(self) >= 5:

self.sell()

cerebro = bt.Cerebro()

cerebro.addstrategy(TestStrategy)

# Data feed integration here

cerebro.run()

This snippet illustrates a simple momentum strategy which you can build upon with more sophisticated risk management rules.

3. Risk Management and Regulatory Adherence

Efficient risk management in backtesting translates directly to live trading performance. Monitor performance metrics such as Sharpe ratios, maximum drawdown, and profit factors rigorously. Prop firms must align these practices with regulatory standards (e.g., NFA rules, ESMA guidelines), ensuring every strategy passes rigorous compliance and documentation reviews.

Case Study: Enhancing Strategy Performance with Automated Tools

A mid-sized prop trading firm recently overhauled its strategy development process using a combination of TradingView, NinjaTrader, and QuantConnect. Initially, their backtesting process suffered from overfitting and delayed optimizations. By integrating these platforms, the firm was able to:

- Reduce backtesting cycle times by 40% through automated parameter optimization.

- Improve the average Sharpe ratio of live strategies by 0.3 points via rigorous out-of-sample testing.

- Minimize drawdowns and improve scenario stress testing, ensuring robust risk management.

This case underscores the importance of using multiple tools for different aspects of trading automation, as each platform contributed unique strengths to the overall process.

Expert Guidance and Pro Trading Tips

Pro Tip: Never rely solely on historical simulations. Always integrate forward testing (paper trading) and continuous monitoring before committing capital. Combining automated backtesting with qualitative market analysis can mitigate the risk of unforeseen market conditions.

Industry Insight: Incorporate automated scenario analysis to anticipate market shifts. This approach not only fortifies your strategy but also supports real-time adjustments in volatile market conditions.

Figure 2: An AI trading tool interface breaking down market indicators and risk metrics for real-time decision making.

Next Steps: Elevate Your Trading Strategy

For experienced traders and prop firm decision-makers, integrating top-tier automation tools like Signal Stack and advanced AI trading software helps streamline strategy optimization and risk management. Start by reviewing your current backtesting framework. Enhance your systems with walk-forward optimization, robust forward testing, and regular compliance audits.

Consider exploring our advanced prop trading strategies and risk management checklist for further detailed guidance.

Conclusion

The evolution of prop trading demands cutting-edge technology and disciplined strategy testing. By leveraging the top 7 automation tools, funded traders can sharpen their competitive edge, mitigate risks, and achieve consistent performance in an increasingly regulated landscape. Embrace these tools today to transform your trading workflow and stay ahead in this dynamic arena.

Remember: Continuous learning and adaptation are vital in prop trading. For a detailed checklist on effective backtesting and risk evaluation, download our comprehensive Risk Management Checklist and subscribe to our newsletter for ongoing expert insights.

As of October 2023, staying updated on regulatory changes and technological advancements is paramount for every prop trader.