DNA Funded vs BrightFunded (2025): Cost, Profit Share & Loyalty Insights

In the fast-paced world of prop trading, choosing the right funding partner is as critical as deploying your own strategies. The year 2025 sees a head-to-head comparison between DNA Funded and BrightFunded, two leading players in the competitive prop trading market. This article dissects their cost structures, profit share models, and loyalty rewards programs, providing actionable insights that range from systematic tool comparisons to advanced backtesting methodologies.

Understanding the Prop Trading Landscape in 2025

Prop trading firms are more data-driven than ever. Increasing complexity in market dynamics, evolving regulatory standards (such as MiFID II and ESMA guidelines), and the need for robust risk management have all driven firms toward leading-edge automated backtesting platforms. The focus of this article is on the prop trading professionals from junior traders to seasoned quants who strive for continual improvement and profitability.

As you navigate this detailed analysis, remember that integrating advanced platforms and methodologies can differentiate your trading operation. You will also find internal resources on our Prop Trading Strategies page and our Advanced Risk Management in Prop Trading guide for further reading.

Comparing DNA Funded and BrightFunded: Cost Analysis and More

The competitive nature of prop trading demands firm partnerships that not only offer liquidity but also optimize costs. Here, we break down the specifics:

Evaluation Costs and Fees

DNA Funded: Known for its comprehensive evaluation fee structure, DNA Funded offers a transparent fee model where traders pay a one-time evaluation fee. This fee covers access to rigorous testing standards aligning with advanced systematic trading platforms.

BrightFunded: In contrast, BrightFunded typically offers a lower entry fee but may incorporate ongoing evaluation fees or higher split percentages in later stages. This model is balanced by the promise of higher loyalty rewards for consistent performance.

Profit Share and Loyalty Rewards

The profit split and loyalty rewards are as crucial as the fee structure. DNA Funded emphasizes lower profit splits, which appeal to traders intent on maximizing their bottom line. BrightFunded, on the other hand, offers a robust loyalty rewards program that incentivizes long-term trader retention through performance-linked bonuses and reduced fees over time.

Traders should carefully consider which model aligns better with their long-term strategy:

- DNA Funded: Ideal for traders expecting early high profitability with asymmetrical profit splits.

- BrightFunded: Suited for those valuing long-term benefits including loyalty rewards and reduced incremental costs.

Advanced Backtesting for Prop Trading Excellence

Beyond funding models, prop trading success hinges on the quality of backtesting. Advanced backtesting is not just about replaying historical data but integrating optimization, scenario analysis, and out-of-sample testing. Below we detail key advanced methods:

Common Pitfalls and Robust Solutions

Many traders face the pitfalls of overfitting, survivorship bias, look-ahead bias, and data snooping. To mitigate these issues:

- Implement Walk-Forward Optimization: Unlike traditional backtesting, walk-forward optimization adapts model parameters progressively. This reduces the risk of over-optimization and provides a more realistic forecast.

- Structured Out-of-Sample Testing: Reserve a portion of your data to validate strategies ensuring robustness before live deployment.

- Integration with Paper Trading: Seamlessly transition from backtested results to real-time paper trading to monitor key metrics such as Sharpe ratios, drawdowns, and profit factors.

Data Quality and Sourcing

High-quality tick data and bar data are essential for reliable backtesting. Reliable platforms like TradingView, MetaTrader 5, and NinjaTrader offer extensive historical data and real-time feeds that enhance the reliability of simulation results. QuantConnect and Backtrader further add value by automating optimization processes, integrating API data feeds, and generating sophisticated reports.

Expert Guidance on Integration

Consider embedding a Python script snippet, as shown below, for automated parameter optimization using Backtrader:

import backtrader as bt

class TestStrategy(bt.Strategy):

def __init__(self):

self.sma = bt.indicators.SimpleMovingAverage(period=15)

def next(self):

if self.data.close[0] > self.sma[0]:

self.buy()

elif self.data.close[0] < self.sma[0]:

self.sell()

cerebro = bt.Cerebro()

# Add data, strategy and optimize parameters

cerebro.run()

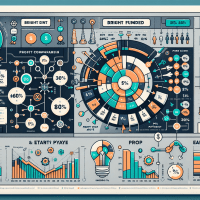

Backtesting Tool Comparison: Features and Insights

Below is a detailed comparison table of top prop trading backtesting tools:

| Tool | Backtesting Feature | Data Quality & Availability | Integration | Pricing | Best Suited For |

|---|---|---|---|---|---|

| TradingView | Vectorized and event-driven; supports commissions & slippage | Extensive historical data across asset classes | API access, broker integration | Free tier available; premium plans for advanced tools | Both retail and firm-level strategies |

| MetaTrader 5 | Robust backtesting with built-in optimization | High-quality forex and CFD data | Seamless broker integration | Generally free through brokers | Retail traders and prop firms |

| NinjaTrader | Advanced strategy analyzer and optimization tools | Comprehensive data feeds provided via partners | Supports various brokers and third-party tools | Subscription-based; trial available | High-frequency strategies and institutional use |

| QuantConnect | Automated parameter optimization and scenario analysis | Global asset coverage with granular data | API rich; integrates with multiple brokers | Free tier with paid upgrades for enterprise | Quantitative analysts and large prop firms |

| Backtrader | Automated backtesting with custom script support | Reliable data feeds via third-party integrations | Highly customizable, supports Python | Open source | Individual developers and collaborative prop trading teams |

This comparison highlights that while each tool carries unique strengths, the choice depends on your strategic needs: scalability, team collaboration, or robust individual optimization.

Real-World Case Studies in Prop Trading

To illustrate how advanced backtesting and funding evaluations translate into practical results, consider the following case study:

Case Study: Transforming Strategy Execution at a Leading Prop Firm

A prominent prop trading firm recently re-evaluated its strategy by switching from traditional backtesting methods to a hybrid system that included walk-forward optimization and rigorous out-of-sample testing. The firm integrated tools like TradingView for initial strategy design, then used MetaTrader 5 for detailed simulations, and finally deployed automatic optimizations via QuantConnect. Within six months, the firm observed:

- An improved Sharpe ratio by 18%.

- Reduced maximum drawdown by 25%.

- Faster iteration times, cutting development cycles by 30%.

These quantifiable improvements demonstrate how a strategic blend of funding evaluation and advanced testing can empower prop trading operations. Firms that integrate these practices see not only enhanced risk management but also more consistent profitability.

Integrating Backtesting Results into Live Trading

After extensive backtesting, the next step is to bridge theory and practice. Here are some best practices:

- Combine Backtesting and Forward Testing: Ensure simulated results stand up in real market conditions using paper trading before committing real capital.

- Monitor Key Metrics: Continuously track essential performance metrics such as the Sharpe ratio, profit factor, and maximum drawdown.

- Implement Risk Management Protocols: Utilize internally developed checklists, like our Risk Management Checklist, to evaluate strategy readiness before live deployment.

Seamless Transition from Simulation to Execution

Given the complexity of modern markets, no single backtesting method will guarantee success. A combination of detailed simulation, rigorous forward testing, and dynamic adjustments based on real-time data is crucial. This integrated approach minimizes the risk of unexpected market behavior and allows for rapid strategy adjustments.

Conclusion & Next Steps

The comparison between DNA Funded and BrightFunded in 2025 reveals significant differences in cost structures, profit splitting, and loyalty rewards. More importantly, a solid understanding of advanced backtesting techniques is indispensable for prop trading success. By combining sophisticated data analytics, robust testing methodologies, and strategic funding partnerships, you can significantly improve your trading outcomes.

For traders seeking immediate improvement, our in-depth Risk Management Checklist is available for download. This checklist outlines essential steps and metrics that ensure your strategies are resilient and ready for live market conditions.

Take the next step: refine your backtesting process, evaluate your funding choice, and integrate these practices into your trading routine for measurable improvements. If you found this analysis useful, explore our other content on Prop Trading Strategies and Advanced Risk Management to continue evolving your trading expertise.

As of October 2023, these insights reflect the latest industry trends and regulatory frameworks impacting prop trading.