BrightFunded Trade2Earn: DNA Funded Alternatives (Feb 2025)

In today’s competitive prop trading environment, staying ahead means not only understanding the fundamentals but also leveraging advanced tools and actionable insights. The BrightFunded Trade2Earn program emerges as a compelling alternative to DNA Funded, offering enhanced loyalty benefits and innovative pathways for traders. This comprehensive guide dives into crucial prop trading strategies, advanced backtesting techniques, and real-world case studies to help both new and experienced traders optimize their performance.

Advanced Prop Trading Strategies for Maximum Impact

Prop trading demands a blend of technical acumen, strategic risk management, and innovative tactics. In this section, we explore strategies used by top prop trading firms that are consistently outpacing market trends.

Key Elements of Successful Trading Firms

- Proven Risk Management Techniques: Maintaining a strict maximum drawdown limit and aiming for profit factors above 1.5 is critical.

- Optimized Backtesting: Using walk-forward optimization rather than traditional static models minimizes overfitting and survivorship bias.

- Advanced Analytics Integration: Integration with APIs and real-time data feeds ensures that strategies can adapt rapidly to market conditions.

Traders should also focus on practical metrics like the Sharpe ratio and consistent performance across timeframes to truly excel in a prop firm environment.

Integrating Advanced Backtesting Techniques

Backtesting is a critical component in the journey toward developing a robust trading strategy. It is vital to avoid common pitfalls such as overfitting or data snooping. As an example, using automated tools can help bridge the gap between model development and live trading execution.

Common Pitfalls and How to Avoid Them

- Overfitting: Ensure your model is validated with out-of-sample data. Incorporate walk-forward optimization to simulate various market scenarios.

- Survivorship Bias: Use comprehensive data sets that include delisted or failed assets.

- Look-Ahead Bias: Strictly partition historical data into training and testing sets.

For traders, this means using tools that seamlessly blend automation with the flexibility of manual adjustments to fine-tune strategies. Below is an example code snippet using Backtrader in Python to illustrate a basic automated strategy scenario:

import backtrader as bt

class TestStrategy(bt.Strategy):

def __init__(self):

self.sma = bt.indicators.SimpleMovingAverage(self.data.close, period=15)

def next(self):

if self.data.close[0] > self.sma[0]:

self.buy()

elif self.data.close[0] < self.sma[0]:

self.sell()

cerebro = bt.Cerebro()

data = bt.feeds.YahooFinanceData(dataname='AAPL', fromdate=datetime(2020, 1, 1), todate=datetime(2021, 1, 1))

cerebro.adddata(data)

cerebro.addstrategy(TestStrategy)

cerebro.run()

cerebro.plot()

Comparative Analysis: Leading Automated Backtesting Tools

When it comes to modern prop trading, several backtesting platforms have emerged as leaders in the industry. Below, we compare key features of TradingView, MetaTrader 5, and NinjaTrader.

| Tool | Backtesting Features | Data Availability & Quality | Integration Capabilities | Pricing & Use Cases |

|---|---|---|---|---|

| TradingView | Vectorized testing, historical performance charts, automated alerts | Extensive global market data with real-time updates | API access, broker integration, add-on analytics | Free tier available, scalable for both retail and prop firms |

| MetaTrader 5 | Event-driven backtesting, advanced strategy optimization, handling of commissions & slippage | Deep historical data across multiple asset classes | API support, expert advisors (EAs) integration | Free download, widely adopted among forex prop firms |

| NinjaTrader | Robust simulation, comprehensive trade analytics, stress testing features | High-quality historical tick and bar data | Broker integration, third-party add-ons and analytics platforms | Subscription-based, ideal for institutional prop trading environments |

This detailed comparison offers insight into how each tool automates the backtesting process—providing traders with automated parameter optimization, sophisticated report generation, and scenario analysis to test various market conditions.

Figure 1: Automated backtesting tool interface displaying performance metrics.

Implementing Walk-Forward Optimization

Walk-forward optimization is a game changer in reducing overfitting and ensuring the robustness of trading strategies. By continuously updating the model with new market data, traders can simulate real-world conditions more accurately. This technique uses rolling windows of historical data to adjust parameters dynamically.

How Walk-Forward Optimization Enhances Trading

- Real-Time Recalibration: Models adjust to market shifts, reducing the risk of outdated parameters.

- Minimization of Overfitting: By constantly validating on new data, the strategy remains robust against overfitting.

- Enhanced Predictive Accuracy: Offers a more realistic expectation of future performance.

For those following these methods, integrating walk-forward analysis with tools such as QuantConnect or NinjaTrader can help maintain competitive edge in dynamic market conditions. Internal resources like our Advanced Risk Management Guide provide further clarity on optimizing trading models.

Real-World Case Study: Prop Firm Strategy Transformation

A mid-sized prop trading firm recently revamped its strategy by integrating automated backtesting and advanced data sourcing. The firm faced persistent challenges with inconsistent backtesting outcomes, largely due to data gaps and overfitting in their models.

Case Study Highlights

- Challenge: Flawed backtesting models led to unreliable strategy performance, increasing risk exposure.

- Solution: The firm adopted a blend of NinjaTrader and TradingView. They employed automated parameter optimization and integrated real-time data feeds to ensure continuous model enhancement.

- Outcome: The implementation resulted in a 20% improvement in Sharpe ratio and a significant reduction in maximum drawdown, boosting overall trading confidence.

This case emphasizes the importance of precise tool selection and adherence to advanced backtesting practices, ensuring that both junior traders and senior quants receive actionable insights.

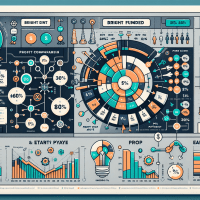

Figure 2: Prop trading data chart illustrating key performance metrics, including Sharpe ratio and drawdown levels.

Advanced Risk Management and Forward Testing

Forward testing, or paper trading, is the logical next step after backtesting. It allows traders to validate strategies in a live market environment without financial risk. Combining these practices ensures that the automated backtest reflects market realities.

Best Practices for Combining Backtesting with Forward Testing

- Start with Controlled Environment: Initiate paper trading with clear risk limits and performance thresholds.

- Monitor Key Metrics: Focus on live performance metrics like maximum drawdown and profit factor differences between backtested and live trades.

- Iterate Quickly: Use the insights gained from paper trading to make swift adjustments before live deployment.

Implementing a robust forward testing framework can reduce the risk of misalignment between historical tests and live trading outcomes. Our detailed Prop Trading Regulations Guide provides additional insights into compliant and effective strategy testing under current regulatory frameworks (e.g., MiFID II, ESMA, NFA).

Expert Guidance: Avoiding Common Backtesting Pitfalls

Pro Tip: Always ensure data quality by using reputable sources for tick data and bar data. Adjust for missing data or corporate actions to avoid skewed results. The rigorous application of out-of-sample testing and scenario analysis further ensures the developed strategies are robust and resilient.

Industry Insight

Many advanced traders have witnessed a dramatic improvement in strategy performance after switching from static backtesting to dynamic, walk-forward optimization. This shift not only enhances predictive accuracy but also improves team collaboration in a prop firm environment.

Conclusion and Next Steps

BrightFunded’s Trade2Earn program offers a strategic alternative to traditional DNA Funded approaches by combining advanced backtesting, real-time data integration, and proactive risk management. Whether you’re a junior trader or a seasoned quant, the insights shared in this article provide the tools needed to elevate trading performance and adapt to ever-changing market dynamics.

For a detailed checklist on optimizing your backtesting process, download our Risk Management Checklist below. Additionally, join our upcoming webinar on integrating automated backtesting with forward testing to secure a competitive edge. Stay ahead by continuously refining your strategies with the latest industry tools and compliance insights.

Remember, in the fast-paced world of prop trading, success is driven by the continuous evolution of your strategies—leverage these expert insights and recommended tools to excel.