Strategic Prop Trading Capital Allocation: Expert Tactics

Strategic Prop Trading Capital Allocation: Expert Tactics

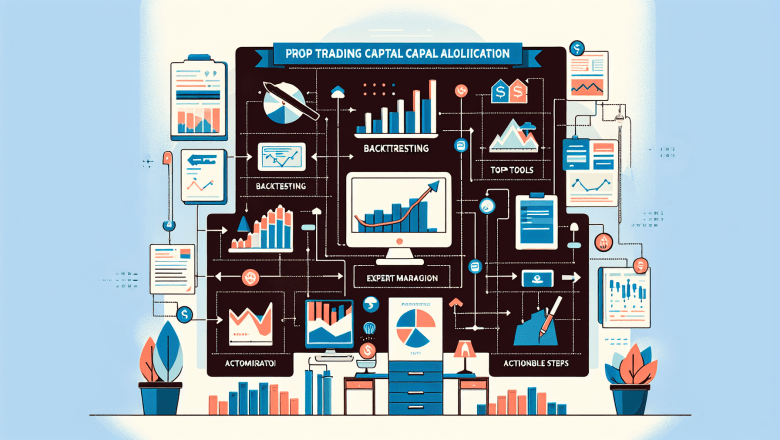

In the highly competitive world of prop trading, capital allocation defines success. With rigorous backtesting, precise risk management, and advanced automation tools, traders and prop firms can gain a significant edge. This comprehensive guide provides actionable insights and detailed comparisons of backtesting platforms, enabling both junior traders and seasoned quants to optimize their strategies effectively.

Understanding Prop Trading Capital Allocation

Prop trading capital allocation involves strategically distributing trading capital across various market strategies to maximize returns while managing risk. In today’s volatile market environments, the ability to allocate funds optimally is critical. This requires a combinat...