Solvent.Life vs Vantir – AI Strategy vs AI Feedback Models

Solvent.Life vs Vantir – AI Strategy vs AI Feedback Models: Advanced Prop Trading Insights

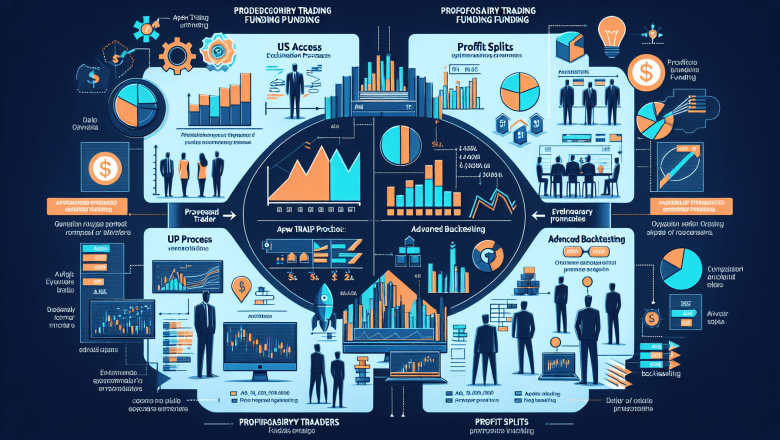

Prop trading professionals and enthusiasts constantly seek innovative strategies to gain an edge in today's competitive markets. In this comprehensive guide, we compare Solvent.Life's AI strategy model and Vantir's AI feedback model, providing actionable insights for traders, quants, and risk managers. Discover detailed tool comparisons, backtesting methodologies, and compliance issues, all designed to empower you with a competitive advantage.

Understanding the Role of AI in Prop Trading

AI-driven models have revolutionized prop trading by automating the analysis of large datasets, optimizing parameter selection, and managing risk dynamically. As firms leverage AI strategies, understanding the diffe...