How to Start Prop Trading: Proven Strategies & Tools

How to Start Prop Trading: Proven Strategies & Tools

Prop trading has evolved from a niche practice to a comprehensive discipline that combines advanced analytics, state-of-the-art tools, and realistic backtesting methodologies. Whether you are a junior trader or a senior quant, this guide is designed to empower you with concrete, actionable steps to kickstart your prop trading journey.

Understanding Prop Trading Fundamentals

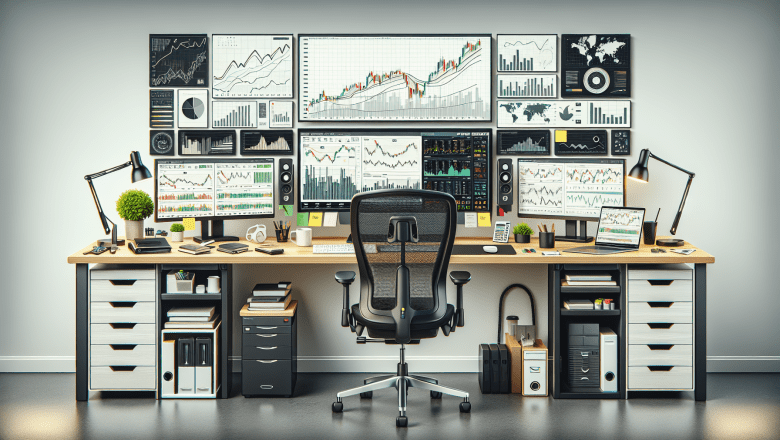

Proprietary trading, or prop trading, involves a firm’s use of its capital for trading in various markets. The benefit for traders is clear: you leverage firm capital rather than your personal funds. This model demands strict adherence to risk management metrics, regulatory compliance, and the continuous pursuit of innovative strategies.

Advanced strategies that driv...