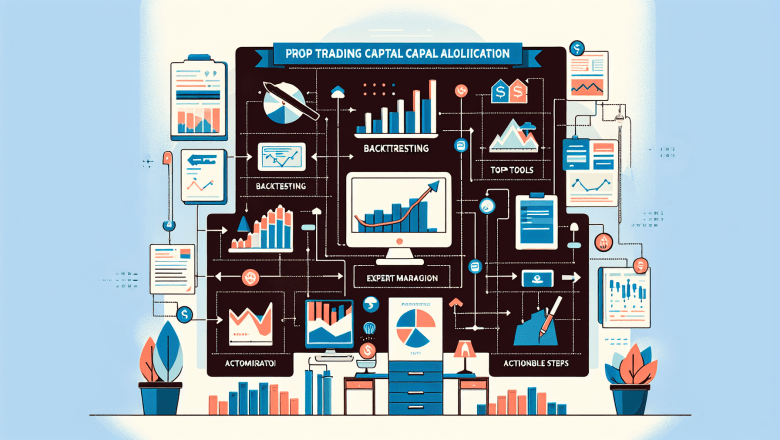

Prop Trading Capital Allocation: Expert Strategies & Tools

Prop Trading Capital Allocation: Expert Strategies & Tools

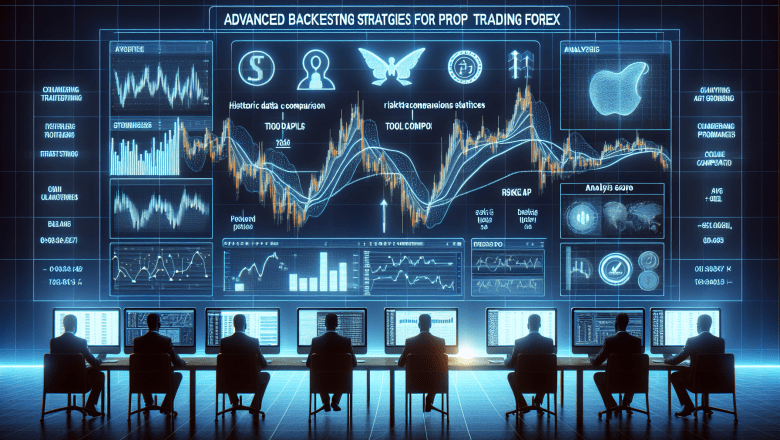

Proprietary trading is no longer solely about high-speed executions and aggressive strategies—it has evolved into a strategic art of capital allocation, backtesting precision, and risk management. In this comprehensive guide, seasoned traders, quants, and risk managers will discover actionable insights into leveraging advanced automated backtesting tools and methodologies to optimize prop trading capital allocation. Explore real-world case studies, practical strategies, and detailed comparisons of top industry tools.

Understanding Prop Trading Capital Allocation

Proper capital allocation in prop trading is essential to ensure profitability and sustainable growth. With the increasing complexity of markets, firms need to harness ...