Proven Prop Trading Automation Strategies

Proven Prop Trading Automation Strategies

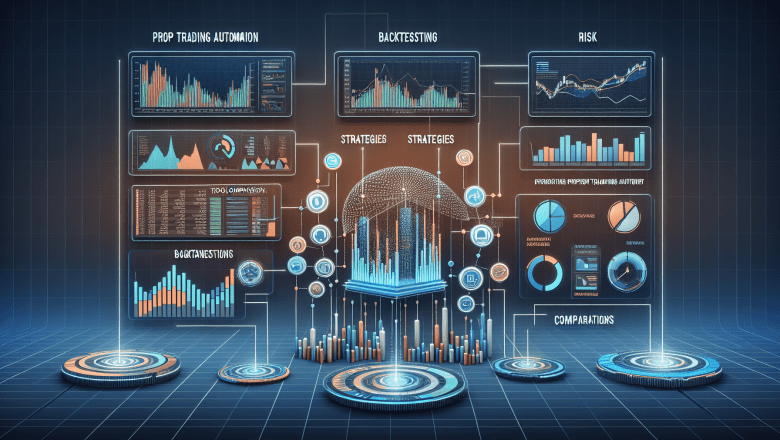

Prop trading is evolving rapidly, and automation has become a cornerstone of developing robust, competitive strategies. In this article, we explore advanced backtesting, dynamic risk management, and real-world tool comparisons to give traders at every level the edge they need. Whether you’re a junior trader or a seasoned quant, these insights will help elevate your prop trading performance.

Understanding Prop Trading Automation

Automation in prop trading leverages sophisticated algorithms and state-of-the-art tools to execute and manage trades with minimal manual intervention. This not only minimizes human error but also helps in processing large volumes of data to uncover subtle market signals. For prop trading firms, automation is not just ab...