Proven Prop Trading Mentorship Programs: Advanced Tools

In the dynamic world of proprietary trading, securing the right mentorship can be a game-changer. This comprehensive guide delivers advanced prop trading insights, focusing on mentorship programs that pair experienced professionals with aspiring traders. Whether you are a junior trader eager to learn or a seasoned prop trading expert refining your strategies, this article provides actionable advice, robust backtesting methods, and current regulatory insights.

Understanding Prop Trading Mentorship Programs

Prop trading mentorship programs are designed to bridge the gap between academic knowledge and real-market expertise. They not only provide structured training but also expose traders to cutting-edge automated backtesting tools and risk management techniques. This guide outlines how mentorship programs can empower both individual traders and entire prop firms to achieve better performance via advanced backtesting and live simulation models.

This initial visual illustrates a typical trading dashboard, highlighting key performance indicators essential for bridging theory and practice.

Advanced Backtesting Strategies in Prop Trading

Backtesting remains a cornerstone for validating trading strategies before live deployment, especially in prop trading environments. Expert traders understand that beyond simple historical data analysis, advanced techniques such as walk-forward optimization, out-of-sample testing, and automated parameter optimization are vital.

Common Pitfalls in Backtesting

- Overfitting: Creating models too tightly bound to historical data may not perform in live markets.

- Survivorship Bias: Relying solely on surviving stocks or instruments skews performance results.

- Look-Ahead Bias: Inadvertently using future data points within the backtest can falsely inflate performance metrics.

- Data Snooping: Repeatedly testing multiple hypotheses on the same dataset increases the risk of false positives.

Implementing Walk-Forward Optimization

This approach involves dividing historical data into sequential segments. A strategy is optimized on one segment (in-sample) and validated on the next (out-of-sample) to ensure robustness against overfitting. For example, integrating Python’s Backtrader framework with a walk-forward algorithm can automate this process:

import backtrader as bt

class TestStrategy(bt.Strategy):

def __init__(self):

self.sma = bt.indicators.SimpleMovingAverage(self.data.close, period=15)

def next(self):

if self.data.close[0] > self.sma[0]:

self.buy()

elif self.data.close[0] < self.sma[0]:

self.sell()

cerebro = bt.Cerebro()

data = bt.feeds.YahooFinanceData(dataname='AAPL', fromdate=datetime(2019, 1, 1), todate=datetime(2020, 1, 1))

cerebro.adddata(data)

cerebro.addstrategy(TestStrategy)

cerebro.run()

cerebro.plot()

Tool Comparisons for Automated Backtesting in Prop Trading

Choosing the right automated backtesting and trading platform is crucial. Below is a detailed comparison of three widely recognized tools:

| Tool | Backtesting Features | Data Quality & Availability | Integration Capabilities | Pricing & Use Case |

|---|---|---|---|---|

| TradingView | Event-driven, vectorized backtesting; supports commission/slippage settings | High-quality historical data across multiple asset classes | API access, broker integrations, and third-party analytics compatibility | Freemium model with advanced tier subscriptions; ideal for both retail and prop firms |

| NinjaTrader | Robust simulation, strategy optimization, stress testing features | Deep historical data with real-time feeds for futures and forex | Extensive API support and custom indicator integration | Competitive pricing for individual traders and scalable solutions for prop firms |

| MetaTrader 5 | Comprehensive strategy backtesting with advanced report generation | Reliable historical data for forex, stocks, and commodities | Robust broker integration and automated trading features | Free demo accounts with affordable live trading tiers; popular among retail and mid-size prop setups |

These tools not only automate backtesting but also offer advanced features like scenario analysis, automated parameter optimization, and stress testing—vital for mitigating the pitfalls mentioned earlier.

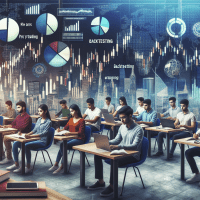

Case Studies: Real-World Application in Prop Trading

Consider the case of a mid-size prop trading firm that implemented an advanced backtesting protocol employing TradingView and MetaTrader 5. Facing issues with overfitting and inconsistent performance metrics, the firm integrated walk-forward analysis and out-of-sample testing into their routine. As a result, they recorded a 15% improvement in Sharpe ratio and a reduction of maximum drawdown by 10%, validating the transition to a more robust, systematic approach.

The above screenshot exemplifies an actual backtesting report, highlighting key performance metrics such as drawdown, profit factor, and Sharpe ratio, which are critical for refining trading strategies.

Expert Guidance on Risk Management and Forward Testing

Effective prop trading strategies are incomplete without rigorous risk management. Alongside advanced backtesting, integrating forward testing (paper trading) adds another layer of validation. Key performance metrics such as the Sharpe ratio, maximum drawdown limits, and profit factor expectations must be monitored consistently.

Risk Management Checklist

A comprehensive risk management checklist for prop traders should include:

- Stop-Loss and Take-Profit Levels: Clearly defined triggers based on volatility and backtested support/resistance levels.

- Position Sizing: Dynamic calculation based on portfolio risk tolerance.

- Diversification: Avoiding concentration risk by spreading exposure across asset classes.

- Trade Frequency and Duration: Guidelines on optimal trade holding times to manage drawdowns effectively.

- Compliance Checks: Adhering to regulatory standards like MiFID II, ESMA, and NFA rules.

Traders should adopt these measures alongside their automated systems to manage risk effectively.

Integrating Forward Testing

Before live deployment, strategies must be verified through forward testing. Integrating backtesting results with paper trading allows traders to observe real-time performance, adjust parameters, and confirm robustness under current market conditions. This iterative process is essential in a prop trading environment, where capital allocation and risk management are paramount.

Regulatory and Compliance Considerations in Prop Trading

Staying compliant with evolving regulations is critical for prop trading firms. With frameworks like MiFID II in Europe, ESMA guidelines, and NFA rules in the US, a robust compliance framework integrated with automated trading systems ensures that strategies meet legal standards while optimizing performance. Firms are advised to regularly update their risk parameters and audit trading systems to align with current regulatory requirements.

Next Steps and Further Resources

For prop trading professionals seeking deeper insights, we recommend exploring our detailed guides on Advanced Prop Trading Techniques and Prop Trading Risk Management. These resources provide further case studies, tool walkthroughs, and a complete checklist for managing trade risks.

Pro Tip: Always stay updated with the latest tool enhancements and market regulations. Subscribing to industry newsletters and joining webinars can be a great way to remain ahead of the curve.

In conclusion, prop trading mentorship programs, combined with advanced backtesting and rigorous risk management, empower traders to excel. Whether you are an aspiring trader or a seasoned pro within a prop firm, integrating these expert strategies into your routine will pave the way for consistent performance improvements. For more details on risk management, download our comprehensive Risk Management Checklist below:

Risk Management Checklist Template

Downloadable Resource: This checklist should include:

- Pre-trade risk assessment with defined stop-loss levels.

- Position sizing rules tailored to portfolio volatility.

- Periodic performance reviews with Sharpe ratio and drawdown analysis.

- Compliance audit steps to ensure regulatory adherence.

Utilize this checklist to regularly monitor and adjust your trading strategies for optimal performance.

Your Next Action: Start by reviewing your current backtesting methods, integrate these advanced strategies, and schedule a risk management audit. A well-rounded approach combining both mentorship and technology-driven methods is key to sustainable trading success.