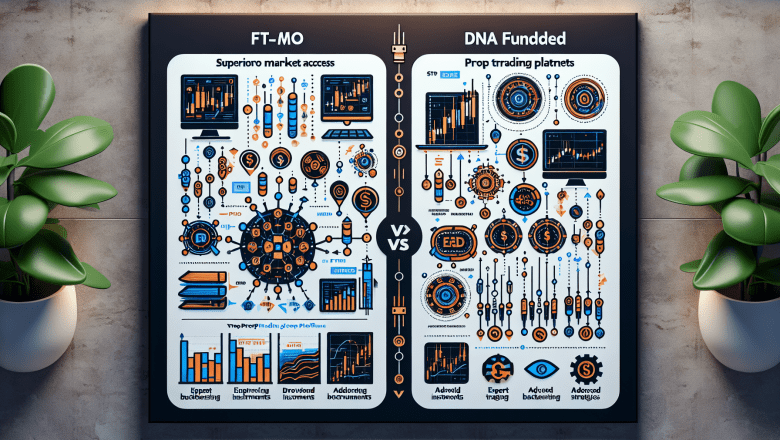

FTMO vs DNA Funded: Market Access & Instrument Variety Reviewed

FTMO vs DNA Funded: Market Access & Instrument Variety Reviewed

Prop trading is evolving, and traders now require robust platforms and deep market access to thrive. In this article, we offer an expert review of FTMO vs DNA Funded, dissecting each platform's market access, instrument diversity and automated backtesting tools tailored for prop trading specialists, from junior traders to risk management experts.

Introduction: Navigating Prop Trading Market Access

The prop trading landscape demands precision, innovation, and real-time data. With institutional-level funding options from FTMO and the growing popularity of DNA Funded, traders must choose platforms that offer not just funding, but robust services such as automated strategies, deep data availability, and advanced backtesting ca...