Top 6 Prop Firms: 90%+ Splits with BrightFunded & DNA

Top 6 Prop Firms: 90%+ Splits with BrightFunded & DNA

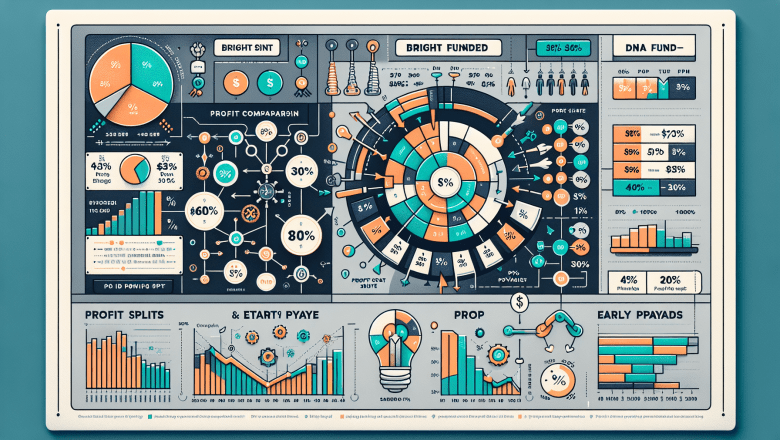

Prop trading requires not only skill but also the right partner to fully leverage your strategies. In this post, we analyze the top prop trading firms with profit splits above 90%, including BrightFunded and DNA Funded tiered models, to help you optimize your trading setup and maximize returns.

Understanding Prop Trading and Lucrative Profit Splits

Prop trading firms provide traders with capital, advanced technology, and competitive profit split models. Firms offering profit splits above 90% have become increasingly popular due to the potential for higher net returns. In today’s market, selecting the right firm is critical for both junior traders and senior quants. This article explores the key benefits of high profit splits and the to...