The Crucial Role of Backtesting in Prop Trading Models

Backtesting is a vital tool in the world of proprietary trading, where it is used to test a trading strategy using historical data. This process helps traders understand how a strategy might perform in the real market, thereby aiding in its refinement before deployment.<\/p>

Components of a Backtesting Framework

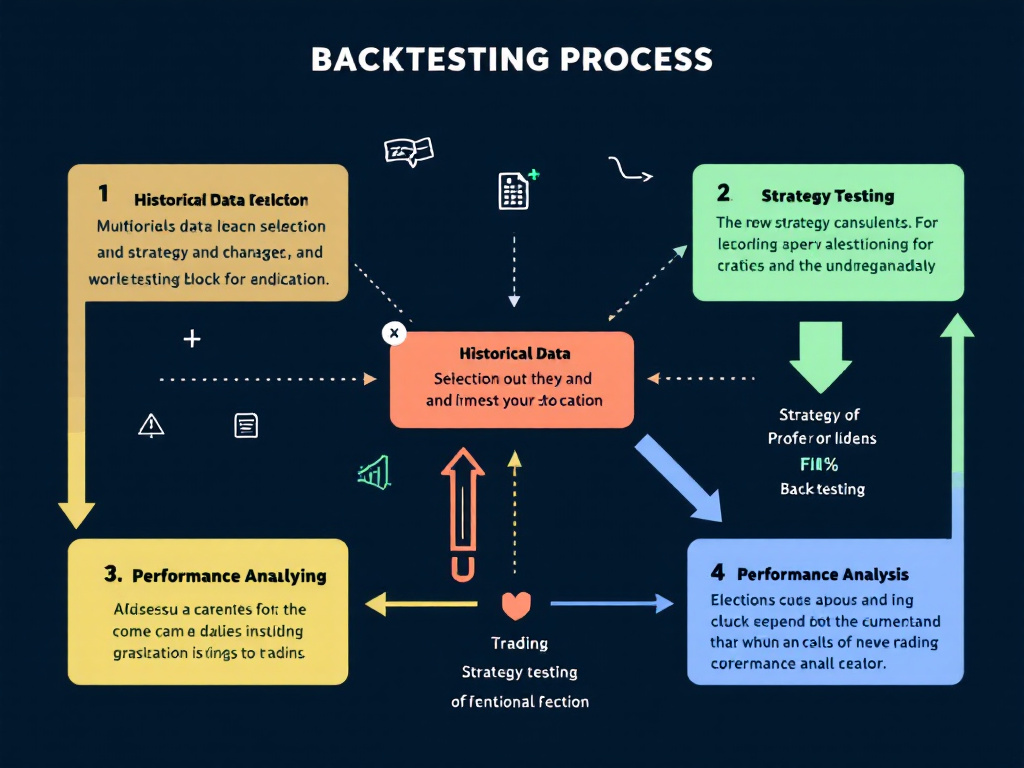

A comprehensive backtesting framework involves selecting relevant historical data, developing a trading strategy, and utilizing analytical tools to measure performance metrics. This process ensures rigorous evaluation and optimization of trading models.<\/p>

Steps to Backtest a Prop Trading Model

The backtesting process starts with gathering clean and reliable historical data. Traders then apply their strategies to see how they would have performed. Key considerations include avoiding common pitfalls such as overfitting and ensuring the assumptions are realistic.<\/p>

Benefits of Backtesting in Prop Trading

Backtesting offers numerous benefits, including enhancing risk management practices and allowing for strategy refinement. It builds trader confidence by proving a strategy’s worth before risking real capital.<\/p>

Challenges in Backtesting

Despite the advantages, backtesting poses challenges, particularly regarding the quality and reliability of data. Traders must be wary of overfitting—a scenario where models are too tightly fitted to historical data, making them ineffective in new market conditions.<\/p>

Tools and Software for Backtesting

There are various platforms available for backtesting, each offering unique features. Traders should choose tools based on criteria like ease of use, customization options, and support for different trading models.<\/p>

Conclusion

As proprietary trading evolves, backtesting will continue to play a pivotal role in strategy validation. Traders are encouraged to integrate backtesting in their models to enhance performance and manage risks effectively, paving the way for successful trading endeavors.<\/p>