Automated Backtesting Tools for Prop Trading: Proven Strategies

In the fast-paced world of proprietary trading, the accuracy and efficiency of automated backtesting tools can make all the difference. Prop trading professionals and enthusiasts alike rely on rigorous strategy testing to ensure that trading models not only perform well historically, but are optimized for real-time market conditions. In this comprehensive guide, we explore top-tier backtesting platforms, address advanced challenges, and provide actionable insights tailored to both prop firms and individual retail traders.

Understanding the Critical Role of Automated Backtesting in Prop Trading

Proprietary trading firms thrive on speed, accuracy, and the relentless pursuit of alpha. Automated backtesting tools assist in evaluating trading strategies against historical data to confirm the robustness of algorithms. They help identify key performance metrics such as the Sharpe ratio, maximum drawdown, and profit factor, ensuring that strategies are statistically sound and align with regulatory compliance like MiFID II and ESMA guidelines.

Comparative Analysis of Leading Backtesting Platforms

Choosing the right backtesting platform can be a game changer. Below we compare several widely recognized tools, examining their features, data quality, integration capabilities, and suitability for prop firms versus retail traders.

TradingView

Backtesting Features: TradingView offers vectorized backtesting with real-time data feeds and customizable commission/slippage configurations. It supports scenario analysis and automated optimization, making it suitable for both rapid testing and in-depth research.

Data Quality and Integration: With access to extensive global market data, TradingView integrates seamlessly with various brokers, offering API support and user-friendly dashboards. It is ideal for prop firms seeking scalability and streamlined collaboration.

Pricing: A range of subscription tiers, including a free plan with basic functionalities and advanced options for professional users.

MetaTrader 5

Backtesting Features: MT5 is known for its event-driven backtesting, capable of handling multi-threaded simulations and advanced charting capabilities. Its strength lies in forex and futures, with detailed reporting on trade metrics.

Data and Integration: Offers reliable historical data across asset classes and tight integration with broker platforms. Though primarily designed for forex, its flexibility makes it popular among both prop trading teams and individual traders.

Pricing: Generally provided through brokerage accounts with a variety of account types and demo versions available.

NinjaTrader

Backtesting Features: NinjaTrader excels in futures and forex backtesting, offering vectorized processing and automated parameter optimization. Its simulation environment includes stress testing features to probe strategy resilience.

Data Quality and Integration: High-quality historical and real-time data, integrated with numerous broker services, and APIs that facilitate custom analytics. It is especially suited for prop firms with dedicated trading desks.

Pricing: Licensing options include free access for sim trading and paid licenses for live trading environments.

QuantConnect

Backtesting Features: QuantConnect provides an open-source algorithmic trading engine supporting both event-driven and vectorized backtesting. It automates parameter optimization and generates sophisticated reports.

Data and Integration: Offers access to massive datasets covering equities, forex, and crypto across various exchanges. It integrates with multiple broker APIs and is renowned for its cloud infrastructure, making it ideal for quant teams within prop firms.

Pricing: Freemium model with advanced features available on subscription.

Backtrader

Backtesting Features: As a Python-based open-source framework, Backtrader is best known for its flexibility, ease-of-use, and community-driven enhancements. It supports detailed customization of commission models, slippage, and optimization routines.

Data and Integration: Provides integration with various data sources and brokers via APIs. Its strong suit is for teams comfortable with Python scripting, making it a favorite for both retail quants and prop firms.

Pricing: Free and open source, with optional premium add-ons available through community support channels.

Advanced Backtesting Concepts for Prop Trading Professionals

While selecting the right platform is critical, understanding advanced backtesting methodologies is paramount for accurate strategy validation. Several pitfalls can compromise test results:

- Overfitting: Relying too heavily on historical data can lead to models that perform well on paper but fail in live markets.

- Survivorship Bias: Excluding assets that have exited the market skews historical performance.

- Look-Ahead Bias: Using future data in historical tests can create unrealistic expectations of strategy performance.

- Data Snooping: Excessive tweaking based on historical noise rather than genuine market factors.

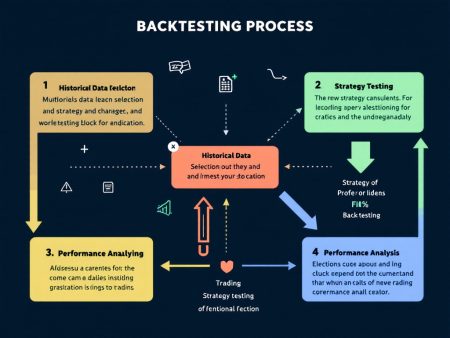

Walk-Forward Optimization vs. Traditional Backtesting

Walk-forward optimization is an approach that incrementally tests a strategy with distinct training and validation periods. Unlike traditional backtesting that uses one static dataset, walk-forward analysis simulates real-world trading by continuously adapting to new data. This process minimizes overfitting, ensuring that strategies remain robust under dynamic market conditions.

Out-of-Sample and Forward Testing

Out-of-sample testing, a crucial technique, involves reserving a portion of historical data that was never used in model training. When combined with forward (or paper) trading, these steps allow traders to confirm the validity of backtested results before committing real capital. As a general rule, a successful strategy should demonstrate consistent performance metrics across in-sample and out-of-sample periods.

Example: Algorithmic Trading with Backtrader

Below is a simplified Python code snippet using Backtrader to automate and optimize trading strategy parameters:

import backtrader as bt

class MovingAverageStrategy(bt.Strategy):

params = (('period', 15), )

def __init__(self):

self.sma = bt.indicators.SimpleMovingAverage(

self.data.close, period=self.params.period)

def next(self):

if self.data.close[0] > self.sma[0]:

self.buy(size=100)

elif self.data.close[0] < self.sma[0]:

self.sell(size=100)

if __name__ == '__main__':

cerebro = bt.Cerebro()

cerebro.addstrategy(MovingAverageStrategy)

data = bt.feeds.YahooFinanceData(dataname='AAPL', fromdate=bt.date2num(bt.DateTime(2015, 1, 1)),

todate=bt.date2num(bt.DateTime(2018, 1, 1)))

cerebro.adddata(data)

cerebro.run()

cerebro.plot()

This snippet highlights how Backtrader can be used to automate strategy execution with built-in indicators and trade size management. More complex strategies might include automated parameter optimization and risk management tools integrated into the testing suite.

Risk Management and Performance Metrics in Prop Trading

Backtesting is not solely about strategy execution—it is also critical in assessing risk via metrics such as the Sharpe ratio, maximum drawdown, and profit factor. Each metric provides unique insight into a strategy’s risk-adjusted returns. For example, a Sharpe ratio above 1.5 is generally desirable for prop trading models, while keeping drawdowns within a manageable range ensures the longevity of trading capital.

Risk Management Best Practices

Prop trading strategies should incorporate:

- Regular Stress Testing: Simulate market shocks to test resilience.

- Capital Allocation Strategies: Dynamic position sizing helps manage risks across various market conditions.

- Compliance Tools: Ensure strategies adhere to regulations such as NFA rules and MiFID II requirements.

Real-World Prop Trading Case Study

A mid-sized prop trading firm recently integrated QuantConnect into their strategy development process. They were facing issues with data inconsistency and excessive optimization that led to overfitting. By adopting QuantConnect’s cloud-based structure, they were able to access richer, more reliable datasets and utilize walk-forward optimization. The outcome was a 20% improvement in the Sharpe ratio and a 15% reduction in maximum drawdown. This case study underscores the importance of choosing the right automated backtesting tool, especially when precision and regulatory compliance are critical.

![]()

View Detailed Report on Facebook

Integrating Backtesting with Forward Testing and Live Deployment

Even after rigorous backtesting, integrating the results with forward testing, such as paper trading, is essential for validating strategy performance in live market conditions. A seamless pipeline from historical analysis to live deployment minimizes the gap between theory and practice, and helps refine strategies in real-time with minimal risk exposure.

Conclusion and Next Steps

Automated backtesting tools are indispensable for prop trading professionals. Whether you are a junior trader testing your first strategy or a senior quant optimizing complex algorithms, leveraging platforms like TradingView, MetaTrader 5, NinjaTrader, QuantConnect, and Backtrader can elevate your trading strategy to new heights. The selection of the right tool along with advanced optimization techniques ensures that your prop trading strategies are both robust and compliant.

For more actionable insights, check out our detailed articles on Prop Trading Risk Management and Proven Prop Trading Strategies. Additionally, download our comprehensive Risk Management Checklist to further refine your trading framework.

As of October 2023, these strategies reflect the latest industry practices and regulatory guidelines, ensuring that you remain at the cutting edge of prop trading innovation.