Mastering Automated Backtesting Tools in Prop Trading

In the fast-paced world of prop trading, staying ahead requires a keen understanding of the latest technologies and strategies. Automated backtesting tools play a crucial role by allowing traders to simulate strategies on historical data, refine their trading methods, and mitigate risks. In this article, we dive deep into the world of automated backtesting tools, focusing specifically on their impact within the prop trading landscape. We will cover how these tools work, show real-world examples, and compare some of the best trading platforms available.

Why Automated Backtesting Tools are Crucial for Prop Trading

Prop trading is all about capitalizing on market opportunities quickly and efficiently. Automated backtesting tools enable traders to analyze massive amounts of data to assess the viability of a trading strategy before risking real capital. This process not only saves time but also enhances decision-making by considering a wide range of market scenarios. Here are a few reasons why these tools are essential:

- Data-Driven Decisions: Evaluate complex strategies using historical market data.

- Risk Management: Identify potential pitfalls before they affect your trading performance.

- Time Efficiency: Automate repetitive tasks and streamline your trading process.

- Performance Metrics: Gain insights into performance metrics crucial for prop trading firms and individual traders alike.

Key Features to Look for in Backtesting Software

When selecting an automated backtesting tool, traders need to look beyond the surface. A robust tool will include advanced features such as:

- Real-Time Simulations: Ability to simulate trades under current market conditions.

- Multi-Asset Support: Tools that support stocks, futures, options, and forex.

- Customizability: Flexibility in testing custom algorithms and strategies.

- Accessibility to Historical Data: Extensive databases that span various market cycles.

- User-Friendly Interfaces: Intuitive dashboards and reports that facilitate easy interpretation of results.

A Closer Look at Real Automated Backtesting Tools

Now, let’s explore some of the leading automated backtesting tools used by prop trading professionals:

TradingView

TradingView is renowned for its powerful charting tools and extensive community scripts, making it ideal for prop traders looking for real-time data and collaborative insights. Its user-friendly interface and robust scripting language, Pine Script, allow for the creation and backtesting of custom strategies.

MetaTrader 5

MetaTrader 5 is favored for its multi-asset trading capabilities, high-speed order execution, and a comprehensive suite for technical and fundamental analysis. It is particularly well-suited for forex and CFD prop trading due to its extensive historical data and backtesting engine.

NinjaTrader

NinjaTrader offers an advanced trading simulation environment, excellent for both backtesting and live trading. It supports automated trading systems, providing traders with detailed analysis and customizable strategy development.

QuantConnect

QuantConnect appeals to quant traders with its open-source algorithmic trading platform. It supports multiple asset classes and integrates with cloud infrastructure to perform extensive backtesting, which is particularly beneficial in prop trading research.

Trade Ideas

Trade Ideas leverages artificial intelligence to generate trading signals and simulate various market conditions, making it an excellent choice for prop trading firms that require robust data analysis and risk management features.

Below is an HTML table comparing some of these tools along with their key strengths and best use cases:

| Tool | Strengths | Best For |

|---|---|---|

| TradingView | Powerful charting, community scripts, intuitive interface | Real-time data analysis and strategy development |

| MetaTrader 5 | Multi-asset trading, robust backtesting engine | Forex, CFD, and multi-market prop trading |

| NinjaTrader | Advanced simulation, high-speed execution, customizable | Automated trading system development |

| QuantConnect | Open-source, cloud integration, multi-asset support | Quantitative analysis and algorithmic trading |

| Trade Ideas | AI-driven signals, comprehensive risk management | Data-intensive prop trading and strategy optimization |

Integrating Automated Backtesting into Your Trading Workflow

Incorporating backtesting tools seamlessly into your prop trading workflow can have a dramatic impact on your success. Here are some actionable steps to optimize your strategy:

- Define Clear Objectives: Start with a well-defined trading strategy tailored to your prop trading goals. Document the parameters and desired outcomes to test effectively.

- Leverage Historical Data: Use platforms like MetaTrader 5 and TradingView to access comprehensive historical data. This step is vital in understanding how your strategy would have performed over time.

- Customize Your Testing Environment: Tailor the backtesting tool settings according to your trading style. Utilize NinjaTrader’s advanced simulation features to adjust risk parameters and execution speeds.

- Iterate and Refine: Regularly update your strategy based on the backtesting results. The quant algorithms on QuantConnect, for instance, allow for systematic updates and refined testing scenarios.

- Integrate with Live Trading: Once a strategy proves successful in backtesting, transition to live-market conditions gradually. Use tools like Trade Ideas to monitor real-time market movements while ensuring backtested insights remain applicable.

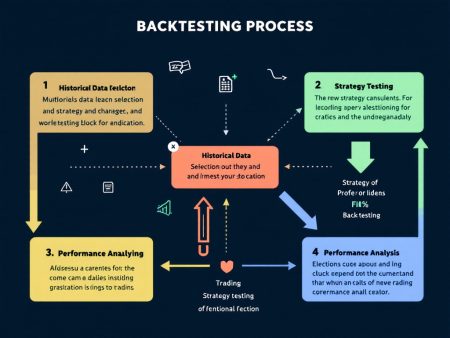

At around one-third through the article, let’s incorporate our first promo image that reinforces the visual appeal and context of our discussion on prop trading strategies:

![]()

This promo image visually represents the analytical approach essential for prop trading, combining data insights with actionable strategy development.

Advanced SEO Strategies for Prop Trading Content

Developing high-ranking content in the competitive prop trading niche requires more than just superior insights. Leveraging advanced SEO strategies will help your articles gain visibility and drive more targeted traffic. Here’s how you can ensure your content stays visible:

- Keyword Optimization: Naturally integrate primary and secondary keywords including long-tail variations like “best automated backtesting tools for algorithmic trading.”

- Internal Linking: Connect to other authoritative prop trading articles on your website. For instance, check out our Prop Trading Strategies guide and our Quantitative Analysis in Trading article for deeper insights.

- Content Depth: Ensure detailed, expert coverage of topics ranging from algorithmic backtesting to strategy simulation.

- User Engagement: Include actionable checklists, downloadable resources, and call-to-action prompts at the end of your posts.

Enhancing Your Workflow with Real-Time Analytics

Integrating a robust analytics system with your automated trading and backtesting platform is essential. Tools such as NinjaTrader and QuantConnect not only enhance backtesting procedures but also offer real-time alerts and performance tracking. In a prop trading environment, where every second counts, having immediate access to performance metrics can be the difference between seizing an opportunity and missing it entirely.

Midway through our discussion, after covering actionable strategies, consider the benefits of visual data representation. Our next promo image serves as a reminder of the blend between analytical rigor and cutting-edge technology in prop trading:

![]()

This promotional image highlights the seamless integration of real-time analytics with automated backtesting, crucial for making informed prop trading decisions.

Real-World Case Study: Optimizing a Prop Trading Strategy

Let’s consider a real-world scenario where a prop trading firm successfully integrated automated backtesting tools. The firm faced challenges in balancing risk management with high-frequency trading decisions. They opted for a multi-tool approach: using TradingView for real-time charts, MetaTrader 5 for extensive historical data analysis, and QuantConnect for algorithm customization.

By backtesting several strategies using these platforms, the firm identified a specific algorithm that showed consistent performance across various market conditions. Regular iterations and data-driven tweaks improved the system’s efficiency, leading to a 15% improvement in overall strategy performance in simulated environments. This approach exemplifies how prop traders can leverage automated backtesting tools to not only test but also refine their trading strategies for optimal performance.

Common Pain Points and Expert Tips

Even with advanced tools at your disposal, several pain points remain common among prop trading professionals:

- Data Quality Issues: Ensure the historical data used for backtesting is extensive and precise. Inaccurate data can lead to misleading results.

- Overfitting: Avoid overly complex models that perform well on past data but fail in live trading. Keep your models as simple as necessary, yet robust enough for market variability.

- Execution Delays: Rapid execution is critical in prop trading. Ensure your chosen platform supports real-time trade execution and minimal delays.

- Software Integration: Compatibility between diverse automated tools is key. Use platforms with proven integration capabilities such as NinjaTrader with third-party analytics.

In conclusion, by choosing the right mix of automated backtesting tools and implementing a disciplined workflow, prop traders can gain a competitive edge. Whether you are an individual prop trader or managing a firm, leveraging these cutting-edge tools will empower you with deeper insights, improved strategy optimization, and stronger risk management.

Call to Action

If you’re ready to transform your prop trading approach, download our free comprehensive prop trading checklist. Stay ahead with the latest insights and join our upcoming webinar on automated backtesting. Sign up now and start optimizing your trading strategies for maximum profit!

For additional resources, explore our in-depth articles on Prop Trading Strategies and Quantitative Analysis, where you can learn more about integrating modern tools into your trading framework.