Proven Automated Backtesting Tools for Prop Trading

In the fast-paced world of proprietary trading, effective strategy testing and risk management are paramount. Prop trading firms and individual traders alike increasingly rely on automated backtesting tools to validate, refine, and deploy trading strategies with precision and speed. In this comprehensive guide, we dive deep into the nuances of automated backtesting, how various industry-leading tools compare, and the advanced methodologies prop trading professionals must leverage to stay ahead.

Understanding Automated Backtesting in Prop Trading

Automated backtesting is a process that allows traders to simulate trading strategies against historical data, ensuring their robustness before live market deployment. This process is critical in prop trading where the need for rapid decision making and risk mitigation is relentless. Advanced automated backtesting tools help in eliminating biases such as overfitting, survivorship, and look-ahead bias, providing firm insights into potential strategy performance.

Why Automated Backtesting is Essential

- Real-time Adaptation: Enables quick adjustments in volatile markets.

- Data-Driven Decision Making: Leverages extensive historical data across multiple asset classes.

- Risk Management: Incorporates critical metrics such as Sharpe ratios, maximum drawdowns, and profit factors.

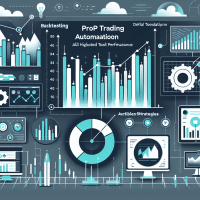

Comparative Analysis of Leading Backtesting Tools

When selecting a backtesting platform, prop traders focus on several key features including data quality, integration with brokers, automation of parameter optimization, and advanced report generation. Below, we compare some leading backtesting platforms widely recognized within the prop trading community:

| Tool | Backtesting Features | Data Quality & Coverage | Integration Capabilities | Pricing & Use Cases |

|---|---|---|---|---|

| TradingView | Vectorized backtesting, script-based custom indicators | Extensive historical data for equities, forex, crypto | API integration, broker links | Flexible subscription tiers; ideal for both retail and prop firms |

| MetaTrader 4/5 | Event-driven backtesting, custom expert advisors | Reliable historical tick and bar data | Direct broker integration, MQL programming | Widely used in forex; suitable for individual traders and small prop shops |

| NinjaTrader | Robust optimization and walk-forward analysis | High-quality futures and forex data | APIs for third-party analytics | Subscription-based; great for team collaboration in prop environments |

| Amibroker | Highly automated parameter optimization, stress testing | Broad asset class coverage with extensive historical data | Custom plugins and API integration | One-time license fee; preferred by advanced quants and institutional traders |

| QuantConnect | Algorithm development, automated report generation, scenario analysis | Deep historical data for multiple markets, including equities and crypto | Seamless API integration with broker services | Cloud-based; excellent for scalable strategies in both retail and prop settings |

Advanced Backtesting Techniques for Prop Trading

As data and technology continue to evolve, it is essential to move beyond traditional backtesting to incorporate more dynamic approaches that simulate live trading conditions. Here are some advanced techniques that every prop trader should master:

Identifying and Overcoming Common Pitfalls

One of the major challenges in backtesting is ensuring that the results are reliable. Some common issues include:

- Overfitting: Excessively tailoring strategies to historical data can produce misleading results. Use cross-validation methods and limit parameter complexity.

- Survivorship Bias: Ensure that the data includes all relevant instruments, not just the winners.

- Look-ahead Bias: Maintain strict separation between training and test periods to avoid unrealistic performance metrics.

- Data Snooping: Avoid repeatedly testing the same pattern until it fits perfectly by using robust out-of-sample testing.

Walk-Forward Optimization vs. Traditional Backtesting

Walk-forward optimization tests strategies over multiple sequential periods, providing a more realistic view of future performance. Unlike traditional backtesting that relies solely on historical data, walk-forward analysis minimizes overfitting by continuously updating parameters as new market data becomes available. This method is particularly beneficial for prop trading where market dynamics change rapidly.

Out-of-Sample and Forward Testing Integration

To fully validate trading strategies, it is critical to conduct out-of-sample tests. Prop traders often follow up backtesting with paper trading or controlled live simulations to assess how the strategy behaves in real-world conditions. Monitoring key metrics such as the Sharpe ratio, maximum drawdown, and profit factor during forward testing helps ensure that strategies perform as expected when live capital is at risk.

Data Quality and Integration Considerations

High-quality data is the backbone of effective backtesting. Traders must source clean, reliable historical data—whether it’s tick data, minute bars, or daily aggregated figures. Significant considerations include:

- Data Depth: Longer data histories capture various market cycles and improve statistical validity.

- Asset Class Coverage: Ensure the backtesting tool can handle various asset classes, from equities and forex to commodities and cryptocurrencies.

- Integration: Tools should provide APIs and integrations with trading execution platforms, enabling seamless transition from backtesting to live trading environments.

Case Study: Enhancing Strategy Robustness at a Prop Trading Firm

Consider a mid-sized prop firm that sought to refine its intraday swing trading strategies. The firm integrated Amibroker for automated backtesting, capitalizing on its advanced parameter optimization and scenario analysis capabilities. Initially, the strategy was underperforming due to overfitting on historical data. By implementing walk-forward optimization and segmenting the data into training and out-of-sample sets, the firm managed to:

- Improve the average Sharpe ratio from 0.8 to 1.5

- Reduce maximum drawdown from 12% to 7%

- Decrease iteration times by 30% thanks to automated parameter tuning

This case demonstrates how detailed tool analysis paired with advanced testing methodologies can yield quantifiable benefits in a prop trading setting.

Integrating Code Examples for Automated Strategy Testing

The integration of automated backtesting with algorithmic execution is further enhanced with code samples. Here’s an illustrative Python script using Backtrader to backtest a simple moving average crossover strategy:

import backtrader as bt

class SmaCross(bt.Strategy):

params = (('fast', 10), ('slow', 30))

def __init__(self):

self.sma_fast = bt.indicators.SimpleMovingAverage(self.data.close, period=self.p.fast)

self.sma_slow = bt.indicators.SimpleMovingAverage(self.data.close, period=self.p.slow)

def next(self):

if self.sma_fast[0] > self.sma_slow[0] and self.sma_fast[-1] <= self.sma_slow[-1]:

self.buy()

elif self.sma_fast[0] < self.sma_slow[0] and self.sma_fast[-1] >= self.sma_slow[-1]:

self.sell()

if __name__ == '__main__':

cerebro = bt.Cerebro()

cerebro.addstrategy(SmaCross)

data = bt.feeds.YahooFinanceData(dataname='AAPL', fromdate=bt.date2num(bt.date2num(bt.date2num(bt.date2num(bt.date2num(bt.date2num(2020, 1, 1)))))))

cerebro.adddata(data)

cerebro.run()

cerebro.plot()

This snippet illustrates the ease of transitioning from strategy conceptualization to quantitative analysis, ensuring that every aspect of the trading plan is rigorously tested.

Risk Management and Further Steps

The final piece in the puzzle is robust risk management. Prop trading firms must integrate backtesting results with forward testing to safeguard capital and ensure regulatory compliance (MiFID II, ESMA, NFA rules). Prioritize metrics such as maximum drawdown thresholds, profit factor, and Sharpe ratios. Moreover, internal collaboration on strategy reviews and compliance checks can help mitigate systemic risks.

Internal Best Practices for Prop Trading Firms

- Regularly update historical data sources to maintain strategy relevance.

- Leverage walk-forward analysis to continuously adapt trading parameters.

- Use detailed performance reports provided by platforms like NinjaTrader and QuantConnect for strategic decision-making.

- Establish a feedback loop integrating paper trading outcomes with automated backtesting results.

For further insights on refining your risk management practices, check out our internal article on Advanced Prop Trading Strategies and our comprehensive Risk Management Checklist.

Conclusion and Next Steps

Automated backtesting tools offer unmatched advantages in prop trading, from enhanced strategy optimization to improved risk management. By understanding advanced testing techniques, comparing market-leading tools, and integrating real world data, traders and firms can decisively improve performance. As market conditions evolve, so must your approach—integrate walk-forward optimizations and rigorous out-of-sample testing to ensure your trading strategies remain competitive.

For prop trading professionals looking to further elevate their strategy testing, we recommend diving deeper into detailed case studies and exploring our downloadable resources, including a complete Risk Management Checklist and a Trading Journal Template designed specifically for prop trading scenarios.

As of today, implementing these strategies and tools can transform your approach to backtesting, test new methodologies, and ultimately drive better risk adjusted returns. Stay ahead in the competitive world of prop trading by continuously learning, testing, and optimizing.