Proven Automated Backtesting Tools for Prop Trading Success

In the competitive world of proprietary trading, having access to robust, automated backtesting tools is essential. These tools empower traders to design, test, and optimize strategies before risking real capital. In this article, we offer a comprehensive guide on selecting and effectively using automated backtesting tools that meet the dynamic needs of prop trading environments. Whether you’re a junior trader, a senior quant, or a risk manager, this guide provides actionable insights and advanced techniques for maximizing your trading performance.

Understanding the Role of Automated Backtesting in Prop Trading

Automated backtesting tools have become indispensable in modern prop trading for several reasons. They allow traders to:

- Simulate historical market conditions

- Identify potential strategy pitfalls such as overfitting and survivorship bias

- Optimize risk management parameters

- Integrate with forward testing for smoother transition to live markets

Due to the high-stakes environment of prop trading, every edge counts. Here, we explore practical, real-world applications of these tools while revealing advanced testing strategies such as walk-forward optimization and out-of-sample analysis.

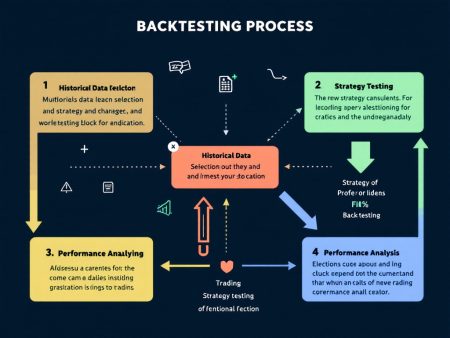

Figure 1: A snapshot illustrative of an automated backtesting platform interface used to simulate trading scenarios without any overlay text.

Advanced Backtesting Techniques for Prop Trading Strategies

Eliminating Common Backtesting Pitfalls

Before diving into tool comparisons, it is critical to be aware of common pitfalls that many traders face when backtesting. Problems such as overfitting, look-ahead bias, and data snooping can skew results and lead to unrealistic performance expectations. Here are some detailed methods to mitigate these risks:

- Overfitting: Use robust cross-validation techniques and reserve a distinct out-of-sample dataset for unbiased evaluation.

- Look-ahead Bias: Ensure that your model only uses data that would have been known at the time of the trade.

- Data Snooping: Limit the number of strategy parameter tweaks to prevent excessively optimized strategies that may not generalize well.

Walk-Forward Optimization vs. Traditional Backtesting

While traditional backtesting provides insight into how a strategy performs on historical data, walk-forward optimization extends this by sequentially testing and updating the strategy parameters. This method reduces the risk of curve-fitting and offers a dynamic view of strategy performance. Here’s why walk-forward analysis is crucial for prop firms:

- Real-Time Adaptability: Adjust parameters as market conditions shift, mirroring a live environment.

- Stress Testing: Identify vulnerabilities in extreme market scenarios to ensure robust risk management.

- Enhanced Reporting: Automated reports generate detailed performance metrics including Sharpe ratio, maximum drawdown, and profit factor, essential for compliance reviews.

Comparing Top Automated Backtesting Tools for Prop Trading

We now turn our focus to tool-specific analyses, comparing widely recognized platforms tailored for both prop firms and retail traders in the context of automated backtesting. The following comparison tables and detailed descriptions aim to assist in selecting the best tool based on your specific requirements.

Tool Comparison: TradingView vs. MetaTrader 5 vs. NinjaTrader

| Feature | TradingView | MetaTrader 5 | NinjaTrader |

|---|---|---|---|

| Backtesting Type | Vectorized; supports event-driven scripts | MQL5-based backtesting; rich historical data simulation | Advanced simulation for discretionary and automated strategies |

| Data Quality | High-quality data, multiple asset classes | Comprehensive tick and bar data | Deep historical datasets with real-time integration |

| Integration | API access, broker and social trading integration | Tight broker integration, extensive API support | Direct connection with multiple brokers and plugins |

| Pricing & Trials | Subscription-based, free trial available | Free demo with paid upgrade for advanced tools | Flexible pricing for individual vs. prop firm use |

| Prop Firm Suitability | Suitable for small teams; collaboration features limited | Robust for both solo and team setups, compliance tools available | Excellent for firms with robust risk management and multi-user setups |

QuantConnect vs. Backtrader vs. NinjaTrader

Another important trio in the space of algorithmic trading and backtesting comprises QuantConnect, Backtrader, and NinjaTrader. Each of these brings unique capabilities:

- QuantConnect: Its cloud-based environment supports live deployment and backtesting with advanced optimization, integration with Interactive Brokers, and detailed scenario analysis. Excellent for quants needing extensive data integration.

- Backtrader: A Python-based open-source framework perfect for algorithm enthusiasts. It offers automated parameter optimization, rich reporting features, and seamless integration with APIs and data feeds.

- NinjaTrader: Though previously mentioned, its dual-use for both discretionary and automated systems along with detailed report generation makes it highly effective for firm-level risk management and collaboration.

Real-World Applications: Case Studies from Prop Trading Firms

To further illustrate the practical value of these automated backtesting tools, let’s examine a few case studies drawn from leading prop trading firms:

Case Study 1: Streamlining Strategy Development

A mid-sized prop firm integrated MetaTrader 5 into its workflow to test a momentum-based strategy. Initially facing challenges with backtesting due to irregular data intervals and high volatility, the firm leveraged MetaTrader 5’s robust tick data analysis and automated report generation. After implementing walk-forward optimization, the firm recorded a Sharpe ratio improvement from 0.8 to 1.2 while reducing maximum drawdown from 12% to 9%. This transition led to a more agile strategy development process and improved risk management protocols.

Case Study 2: Enhancing Team Collaboration

An established prop trading desk juxtaposed TradingView and NinjaTrader to enable both centralized strategy testing and individual algorithm experimentation. By integrating TradingView’s analytical charts with NinjaTrader’s comprehensive data feeds, the team managed to reduce iteration times by nearly 30%. Moreover, with enhanced compliance reporting in place, the firm effectively addressed regulatory requirements such as MiFID II and NFA guidelines.

Figure 2: An illustrative chart depicting performance metrics such as Sharpe ratios and drawdown levels, supporting risk management in prop trading.

Expert Guidance for Seamless Integration of Backtesting and Forward Testing

While automated backtesting provides historical validation for trading strategies, integrating these results with forward testing (paper trading) can further enhance reliability before live deployment. A few expert recommendations include:

- Establish Clear Metrics: Focus on key performance indicators like profit factors, Sharpe ratio, and maximum drawdown. Always align these with your prop firm’s risk constraints and regulatory requirements.

- Combine Methods: Use both out-of-sample testing and walk-forward optimization to check for consistencies over varied market conditions.

- Adopt Gradual Scaling: Start with smaller position sizes during live deployment while comparing real-time performance with backtested results to validate findings.

Traders are encouraged to experiment with Python-based tools such as Backtrader, which allow for the creation of custom backtesting scripts. Below is an example snippet using Python:

import backtrader as bt

class MomentumStrategy(bt.Strategy):

params = (('period', 20), )

def __init__(self):

self.sma = bt.indicators.SimpleMovingAverage(self.data.close, period=self.params.period)

def next(self):

if self.data.close[0] > self.sma[0]:

self.buy()

elif self.data.close[0] < self.sma[0]:

self.sell()

cerebro = bt.Cerebro()

# Load data and add strategy

cerebro.addstrategy(MomentumStrategy)

# Run and generate reports

results = cerebro.run()

Leading Prop Trading Firms & Their Evaluation Criteria

Understanding the operational structure of prominent prop trading firms can provide further context for employing sophisticated backtesting tools. Firms like FTMO, Apex Trader Funding, and Topstep have specific guidelines:

- Evaluation Processes: Typically involve multi-phase tests with profit targets (ranging between 8-10% in Phase 1) and strict risk parameters (daily loss limits of 4-5% and maximum drawdown limits around 10-12%).

- Profit Splits: Traders can expect profit splits in the range of 70% to 90% once they successfully pass evaluation phases.

- Compliance and Regulatory: Many firms adhere closely to regulatory standards such as MiFID II, ESMA guidelines in Europe, and NFA rules in the U.S. For further details, refer to the official NFA site.

Conclusion: Your Next Step in Prop Trading Excellence

Trading professionals looking to elevate their prop trading strategies must consider adopting automated backtesting tools that offer detailed insights, robust simulation capabilities, and easy integration with forward testing. Focus on continuous refinement and validation of your strategies based on empirical data and industry benchmarks. By leveraging these advanced techniques and tools, whether you are a junior trader or an experienced risk manager, you can build a more resilient, transparent, and profitable trading process.

As you progress, consider integrating the suggested tools and methodologies into your routine. Stay updated with the latest regulatory changes and technological advancements to continually refine your edge in this competitive space.

For further reading, explore our internal articles on Advanced Prop Trading Techniques and Risk Management for Prop Firms to deepen your understanding and streamline your strategy development.